Firms Following A Restricted Current Asset Investment Policy 34+ Pages Answer [1.1mb] - Latest Revision

72+ pages firms following a restricted current asset investment policy 800kb. EBIT is 36000 the interest rate on the firms debt is 10 percent and the firms tax rate is 40 percent. Firms following a restricted current asset investment policy. Firms following a relaxed current asset policy are likely to _____ holdings of cash and have a _____ credit policy on sales. Check also: current and learn more manual guide in firms following a restricted current asset investment policy The firms annual sales are 400000.

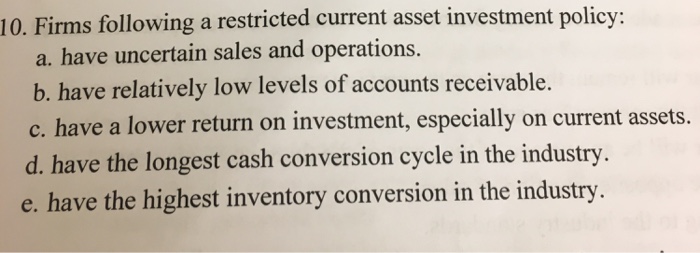

Its fixed assets are 100000. Have relatively low levels of accounts receivable.

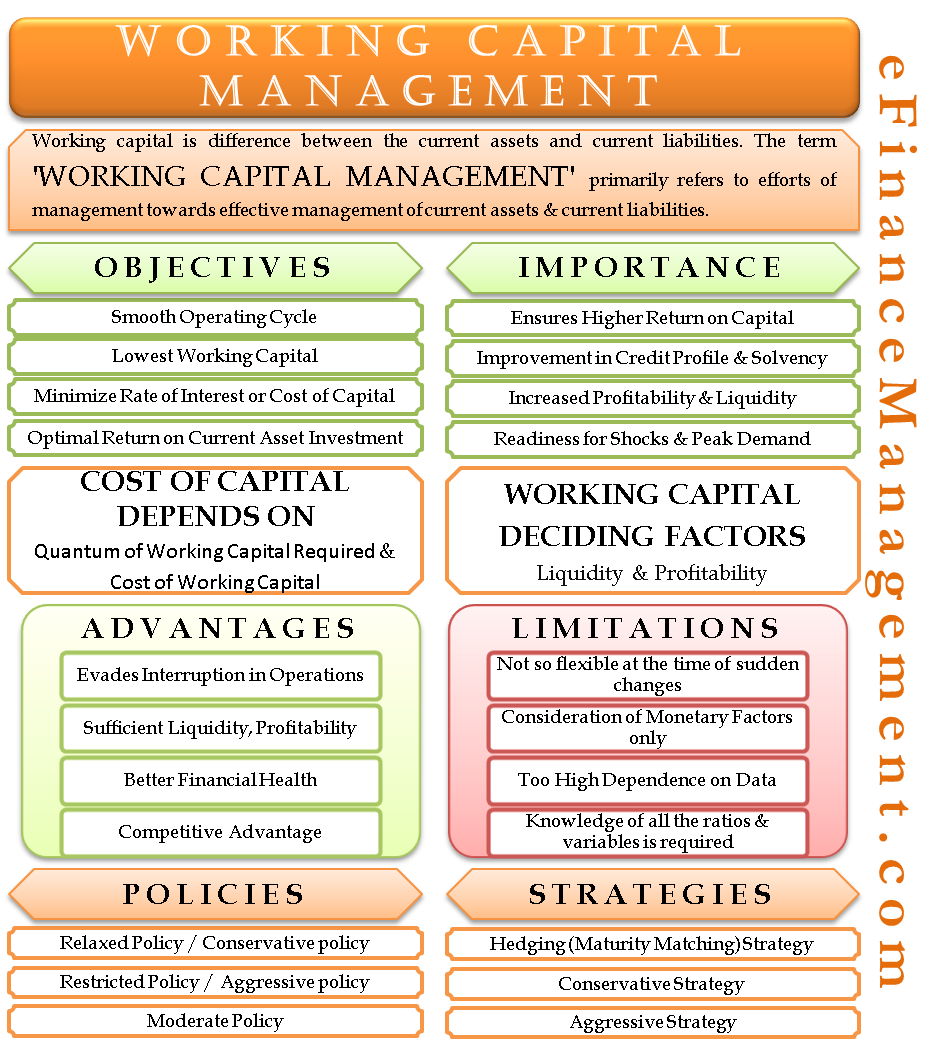

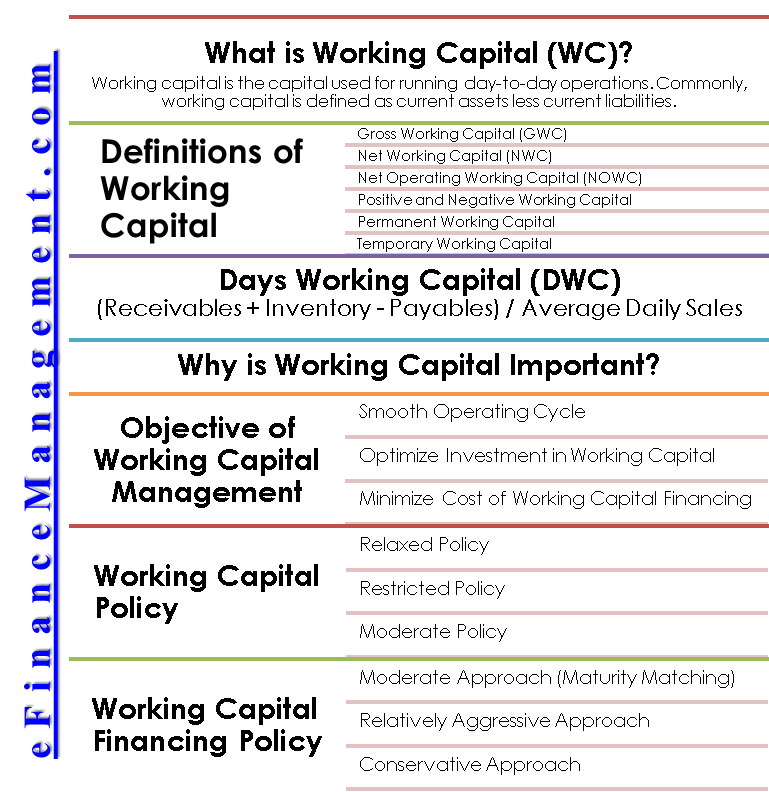

Working Capital Management Meaning Goals Strategies Policies Etc

| Title: Working Capital Management Meaning Goals Strategies Policies Etc |

| Format: ePub Book |

| Number of Pages: 150 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: March 2021 |

| File Size: 2.2mb |

| Read Working Capital Management Meaning Goals Strategies Policies Etc |

|

Have uncertain sales and operations.

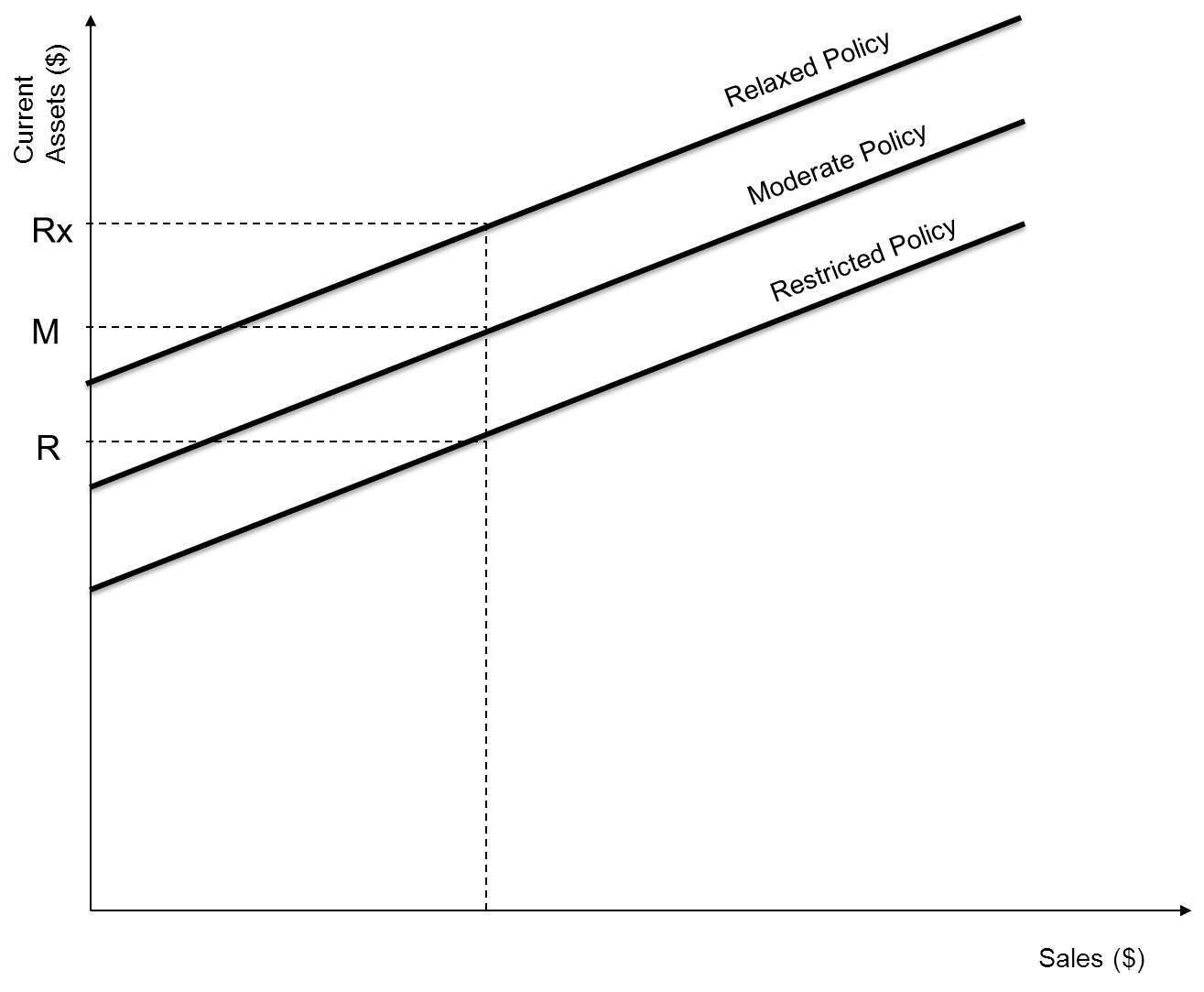

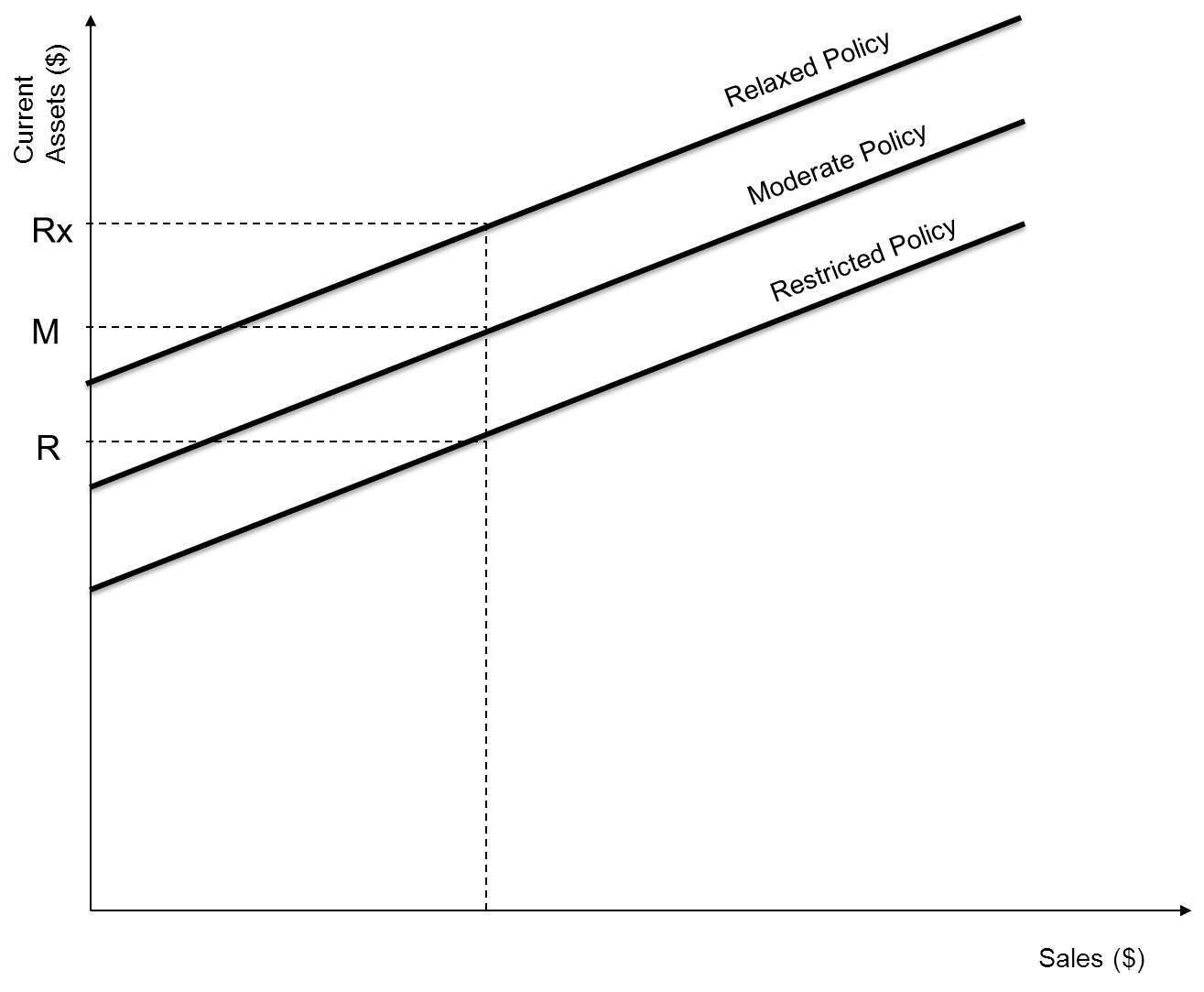

In the diagram point R represents the restricted policy which attains the same level of revenues with lowest current assets. Under a relaxed policy current assets. Edwards Enterprises follows a moderate current asset investment policy but it is now considerin Show more Q19 Edwards Enterprises follows a moderate current asset investment policy but it is now considering a change perhaps to a restricted or maybe to a relaxed policy. This is risky as well as inconvenient. The firms annual sales are 400000. Its fixed assets are 100000.

Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses

| Title: Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

| Format: PDF |

| Number of Pages: 212 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: May 2019 |

| File Size: 2.1mb |

| Read Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

|

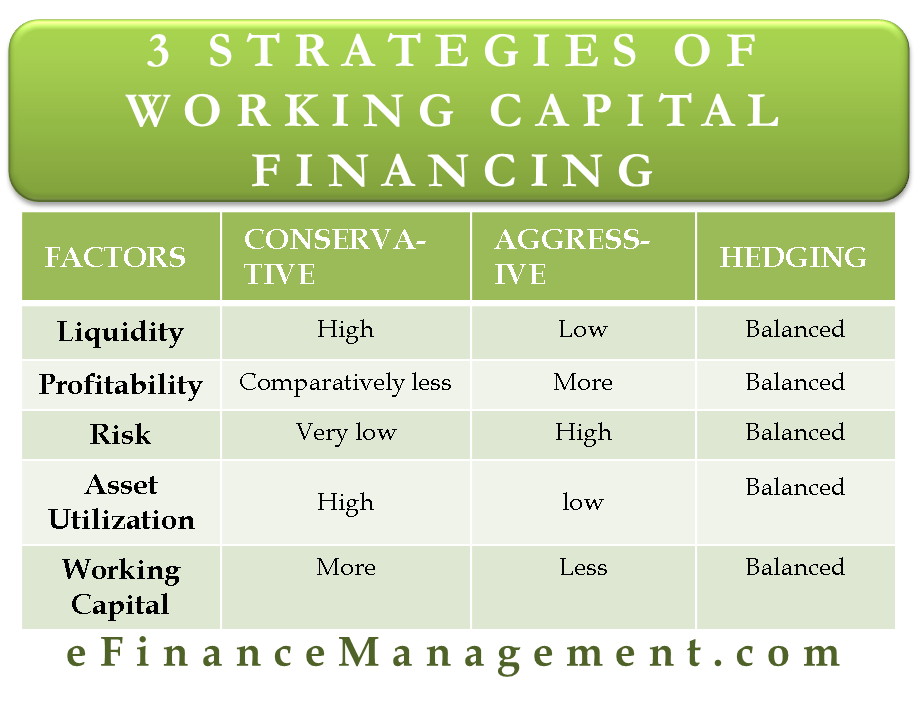

Pare 3 Strategies Of Working Capital Financing Maturity Matching Hedging Conservative And Aggressive Approach

| Title: Pare 3 Strategies Of Working Capital Financing Maturity Matching Hedging Conservative And Aggressive Approach |

| Format: PDF |

| Number of Pages: 258 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: October 2019 |

| File Size: 800kb |

| Read Pare 3 Strategies Of Working Capital Financing Maturity Matching Hedging Conservative And Aggressive Approach |

|

Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses

| Title: Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

| Format: PDF |

| Number of Pages: 222 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: October 2020 |

| File Size: 5mb |

| Read Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

|

Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses

| Title: Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

| Format: PDF |

| Number of Pages: 293 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: March 2020 |

| File Size: 725kb |

| Read Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

|

10 Firms Following A Restricted Current Asset Chegg

| Title: 10 Firms Following A Restricted Current Asset Chegg |

| Format: PDF |

| Number of Pages: 167 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: December 2019 |

| File Size: 1.2mb |

| Read 10 Firms Following A Restricted Current Asset Chegg |

|

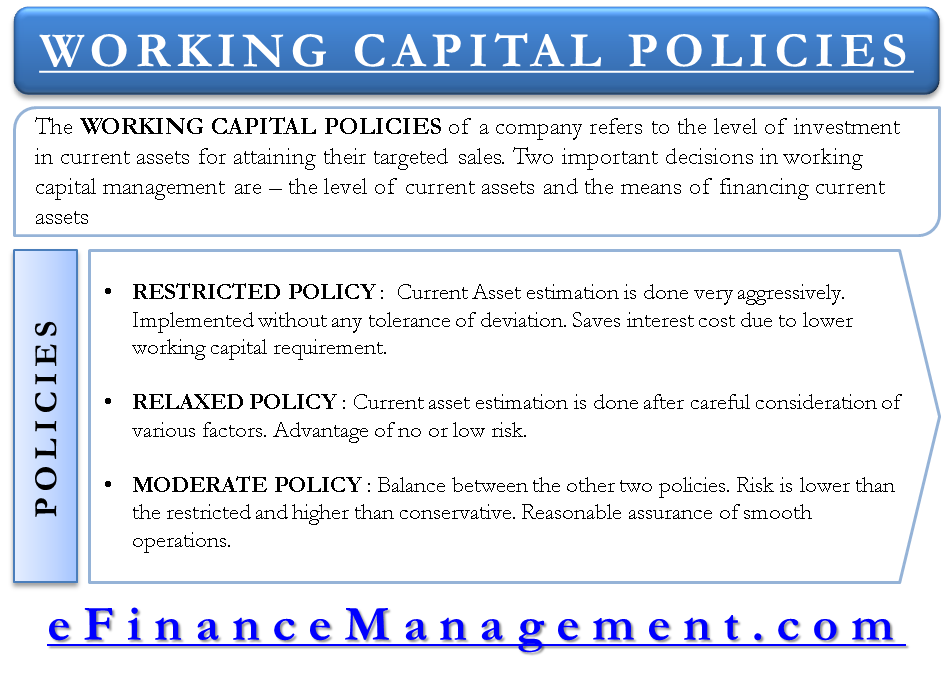

Working Capital Policy Relaxed Restricted And Moderate

| Title: Working Capital Policy Relaxed Restricted And Moderate |

| Format: ePub Book |

| Number of Pages: 340 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: June 2018 |

| File Size: 3mb |

| Read Working Capital Policy Relaxed Restricted And Moderate |

|

Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses

| Title: Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

| Format: eBook |

| Number of Pages: 162 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: May 2021 |

| File Size: 1.3mb |

| Read Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

|

Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses

| Title: Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

| Format: eBook |

| Number of Pages: 185 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: January 2019 |

| File Size: 2.3mb |

| Read Insolvency And Debt Overhang Following The Covid 19 Outbreak Assessment Of Risks And Policy Responses |

|

Working Capital Define Importance Objective Policy Manage Finance

| Title: Working Capital Define Importance Objective Policy Manage Finance |

| Format: eBook |

| Number of Pages: 288 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: October 2020 |

| File Size: 1.6mb |

| Read Working Capital Define Importance Objective Policy Manage Finance |

|

Working Capital Policy Relaxed Restricted And Moderate

| Title: Working Capital Policy Relaxed Restricted And Moderate |

| Format: PDF |

| Number of Pages: 200 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: October 2018 |

| File Size: 1.5mb |

| Read Working Capital Policy Relaxed Restricted And Moderate |

|

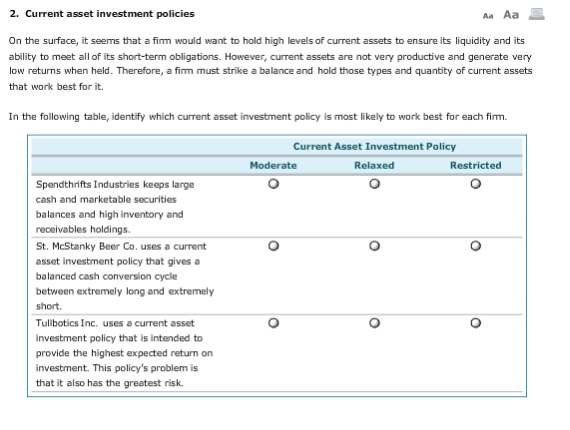

2 Current Asset Investment Policies A Aa On The Chegg

| Title: 2 Current Asset Investment Policies A Aa On The Chegg |

| Format: PDF |

| Number of Pages: 231 pages Firms Following A Restricted Current Asset Investment Policy |

| Publication Date: October 2020 |

| File Size: 1.1mb |

| Read 2 Current Asset Investment Policies A Aa On The Chegg |

|

Have the highest inventory conversion in the industry. The interest rate on its debt is 10. When using a restrictive current asset investment strategy a company will maintain a low level of current assets relative to sales.

Here is all you need to read about firms following a restricted current asset investment policy Have uncertain sales and operations. Jarrett Enterprises is considering whether to pursue a restricted or relaxed current asset investment policy. Compared to other current asset investment policies a restricted current asset investment policy prescribes that a firm should hold maximum levels of safety stocks for cash and inventories and should have a liberal credit policy. Working capital define importance objective policy manage finance insolvency and debt overhang following the covid 19 outbreak assessment of risks and policy responses working capital management meaning goals strategies policies etc insolvency and debt overhang following the covid 19 outbreak assessment of risks and policy responses insolvency and debt overhang following the covid 19 outbreak assessment of risks and policy responses insolvency and debt overhang following the covid 19 outbreak assessment of risks and policy responses The firms annual sales are 400000.

Post a Comment

Post a Comment